Upcoming Events

-

Mar

09-11

2026 Washington D.C. Visit - ABA Washington Summit

View Details -

Mar

31-31

2026 CBA Membership Update: Succession Planning Reimagined

View Details -

May

12-15

2026 Annual Conference & Directors Forum

View Details -

Jun

10-11

2026 Women in Banking Forum

View Details -

Jul

21-21

2026 FDIC Community Bankers Workshop

View Details -

Aug

18-20

2026 Kentucky Bankers Association Fraud Academy

View Details

Featured Articles

Strunk

Risk management is an essential process at every bank. Unfortunately, it also consumes many resources. That’s why Strunk developed Risk Manager—a full-featured GRC solution that simplifies and automates risk management workflow, allowing you to spend less time on process and more time on activities that will actually improve your bank’s risk profile.

Become a Member Today

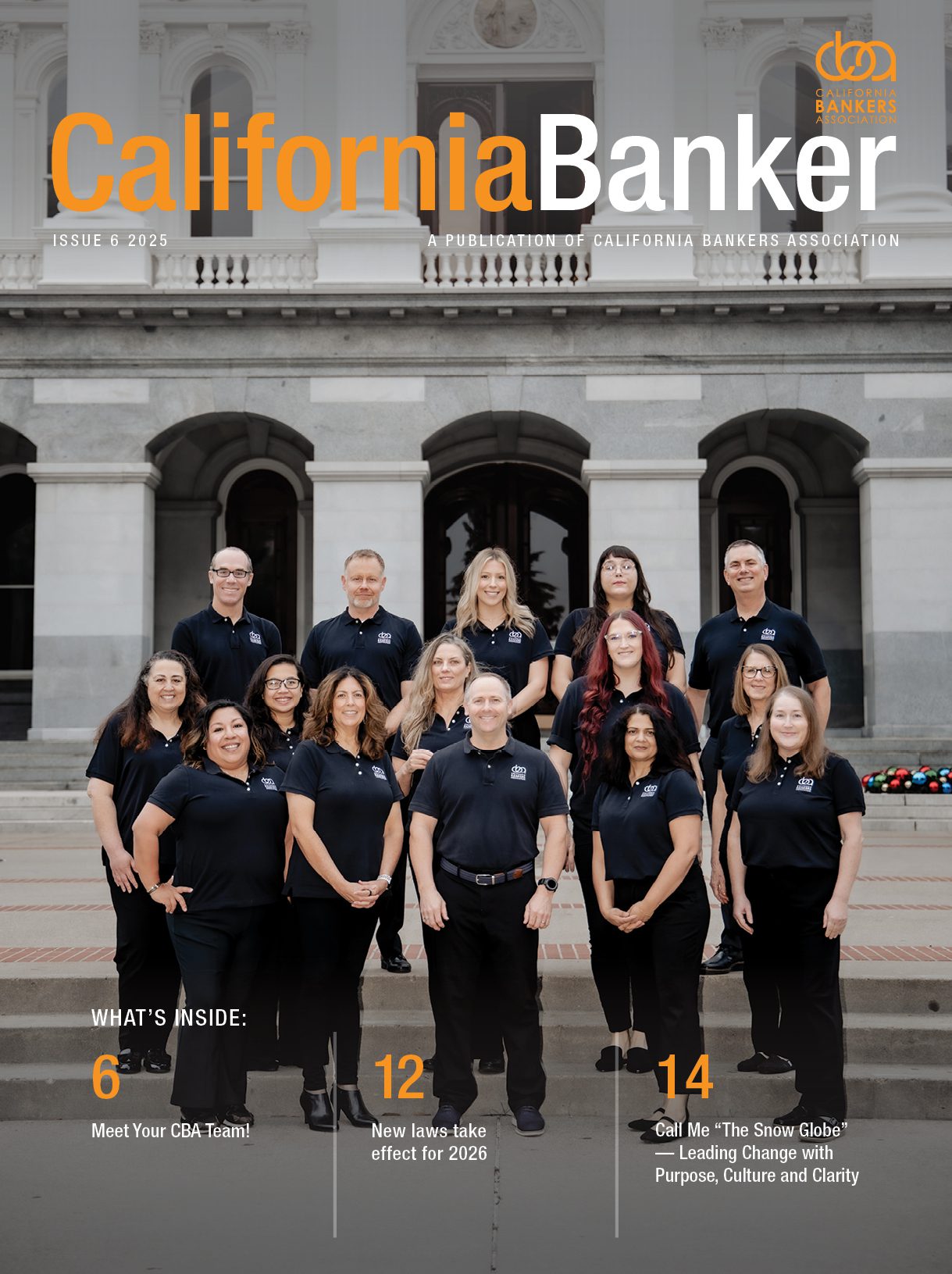

California Bankers Association is built on the foundation and support of the banks we serve and represent. Our mission is to advocate for the California banking industry in the legislative, regulatory and legal arenas, connect bankers, and provide meaningful education programs.